non filing of income tax return consequences

Whether you owe money to the. If any taxpayer is not filing hisher return on time.

Buying Property From Nri And Consequence Of Non Deduction Of Tax Buying Property Deduction Tax

May lead to Best judgment assessment by the AO us 144.

. Late filing fee of Rs. 3 rows Hence even if your income falls under basic exemption limit you might be under the list of. Penalty us 270A which is equal to fifty per cent of the.

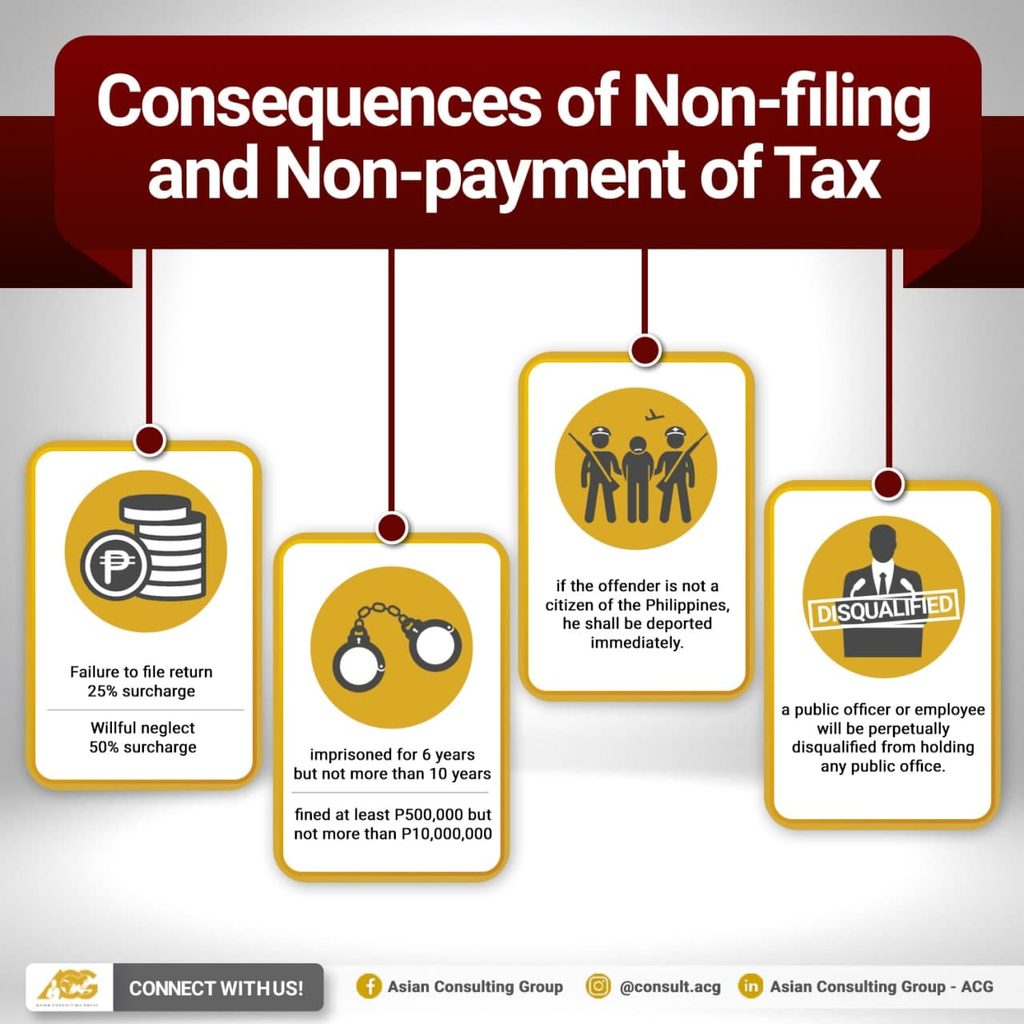

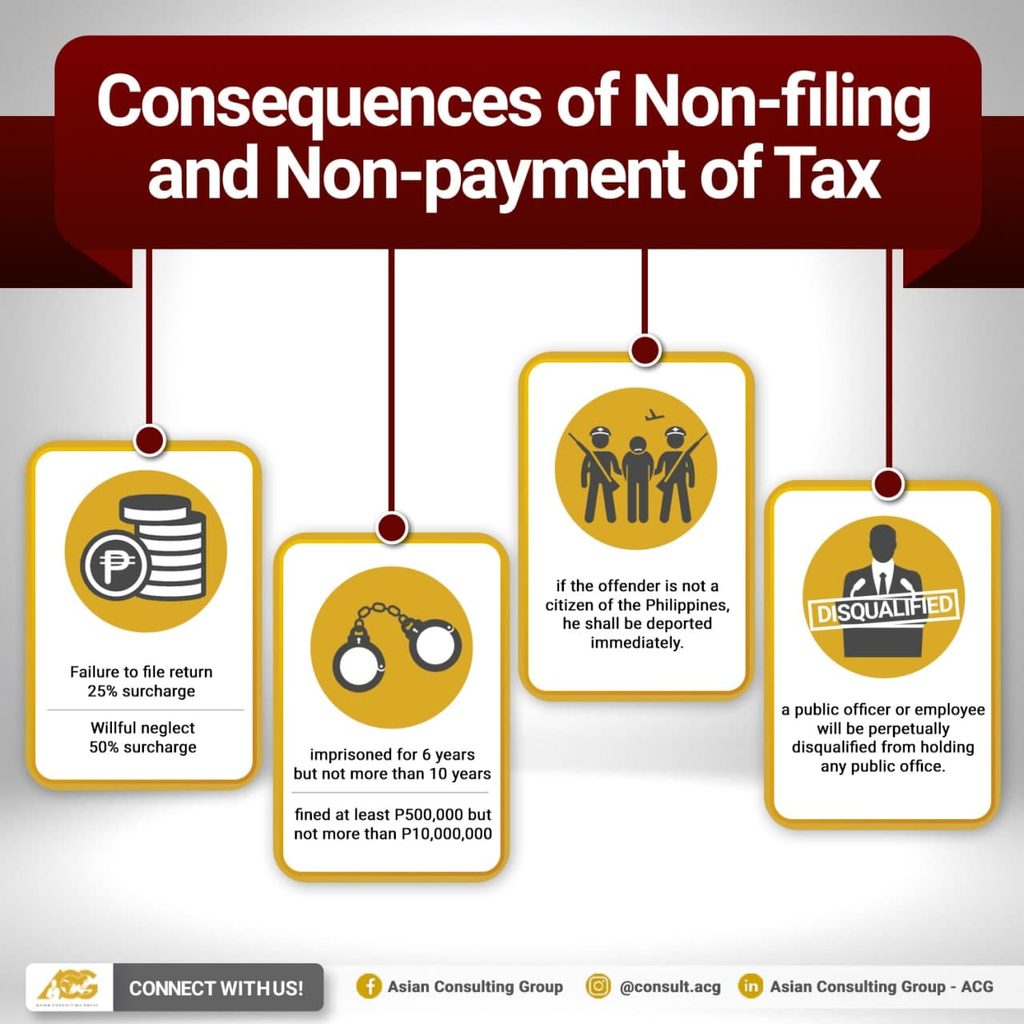

A fine of up to SGD1000. Therefore just keep in mind the above consequences of non filing of your Income Tax Return and start working on it. With 2019 income tax return filing deadline of April 15 2020 looming many taxpayers dread having to prepare their income tax return fear owing money to the IRS.

He also had to pay 140 thousand dollars worth of back taxes and 50. 1 Penalty us 271F. Income tax department can launch prosecution against you for non-filing of ITR The tax laws prescribe minimum three years of imprisonment term and which can extent upto seven years Read Full Story.

The consequences of not filing a personal income tax return include fines liens and even imprisonment. Non- filing of income tax return leads to heavy penalties with interest us 234 A 234 B and 234 C accordingly. If you owe taxes and fail to pay them you could face penalties for failure to pay.

C onsequences of non-filing of Income Tax Return. Take for example the case of the public accountant in Michigan sentences to five months in prison and five months of house arrest for failing to file tax returns for four yes four years. For possible tax evasion exceeding Rs25 lakhs.

Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties. Owing to the lack of awareness or otherwise the Indian Government has observed that many entities. If the return income is not filed and the notice from tax department has been received then there will be a penalty in.

Tax evaders often face large criminal penalties including fines and imprisonment as well as civil penalties. If you fail to file your tax returns on time you may be facing additional penalties and interest from the date your taxes were due. 2Interest on delayednon filing of Income Tax Returns.

If there are any taxes which are unpaid penal interest 1 per month or part thereof will be charged till the. Upon conviction the company may be ordered by the Court to pay. Losses such as business loss speculative or non-speculativecapital losslong term or short term and loss in race horse maintenance are not eligible to be carried forward as per section 80 of the IT Act.

To avoid a penalty. Failing to file a tax return when you make above a certain amount. Ad Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions.

If a company fails to file its Corporate Income Tax Returns for two or more years it may be issued with a summons to attend Court. This is an assessment carried out as per the best judgment of the Assessing Officer on the basis of all relevant material he has gathered. The benefits and importance of doing so are enlisted below.

Military No Return Required. It is mandatory on part of every individual to file the Income Tax Return and also the person will be penalized under section 234A of the Income Tax Act. The tax department levies heavy fines on individuals who do not file and pay their taxes.

Thus Non-filing of Income Tax Return may result in the penalty of Rs. Carry forward of Losses not allowed except in few exceptional cases. Consequences Of Not Filing.

Failure to file or failure to pay tax could also be a crime. A penalty that is twice the amount of tax assessed. Up to 5 business days after filing electronically Up to 3 - 4 weeks after mailing your paper return What information will I receive.

AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1. Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years. Prescribed penalty plus imprisonment of at least 3.

Other than the above some additional implications become applicable if return is not filed by the due date. As per section 234F a fine of Rs10000 will be levied for failing to file tax returns which is quite a heavy price to pay for an average person. Default in the furnishing of the Income Tax Return may attract Interest us 234A.

If a person fails to furnish return before the end of the relevant assessment year the assessing officer may levy a penalty of Rs. Thus Non-Filing of the Income Tax Return may result in the Best Judgement Assessment. E-File FederalState Individual Income Tax Return.

Tax evasion is a serious offense that will leave you with a court hearing marks on your credit and a criminal record. The specifics regarding imprisonment are as follows. Every year the IRS and the media put out lots of information and reminders about the due date for filing your federal tax return.

But here we are discussing only the adverse consequences of Non-Filing of the Income Tax Return. Pay 0 to File all Federal Tax Returns Claim the credits you deserve. Consequences for non-filing of a tax return in India.

What are the consequences of non filing of Income Tax Return. Failure to file Corporate Income Tax Returns for two or more years. Consequences for non-filing of a tax return in India October 2018.

As per the provisions of Indian domestic tax laws every entity including foreign entities in receipt of any income is required to file its Income- tax return in India. Individual Income Tax Calculator. The IRS recognizes several crimes related to evading the assessment and payment of.

If you do not file a return and there is assessable income you are liable to a penalty for concealment of income which ranges from 100 to 300. 495 total views. Ignoring bills and notices from the IRS can lead to a determination of tax evasion.

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return

Pin On Best Of Canadian Budget Binder

Consequences Of Not Filing Taxpayer Advocate Service

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Penalties For Claiming False Deductions Community Tax

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns

Penalty For Late Filing Of Income Tax Return Income Tax Return Income Tax Tax Return

You May Land Up In Jail For Non Filing Of Itr File Income Tax Business Reputation Filing

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

Attention Taxpayers Here Is What Happens When One Files The Itr Timely V S Those Who Fail To File Their Return By Due Tax Refund Income Tax Income Tax Return

Penalty For Late Filing Of Income Tax Return Ebizfiling

What Happens If Itr Is Not Filed What Are The Consequences

Penalty For Late Filing Of Income Tax Return For Ay 2020 21 Income Tax Return Income Tax Tax Return

Consequences Of Non Or Late Filing Of The Income Tax Return

Consequences Of Delay In Filing Itr Non Payment Of Tax And Non Filing Of Income Tax Return Naveen Fintax Income Tax Return Income Tax Tax Return

For How Many Previous Years A Taxpayer Can File Income Tax Return Income Tax Return Income Tax Tax Return

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return